- Risk Queue

- Posts

- Big Banks' Earnings Call Shift Focus on Defending Risk Management ; Which Bank is leading AI Race?

Big Banks' Earnings Call Shift Focus on Defending Risk Management ; Which Bank is leading AI Race?

A Must-Listen: TD's Money Laundering Story Details

Hello everyone! Welcome back to the Risk Queue. This week, Citi is in the hot seat, and the AI race is supposedly being led by JP Morgan. Let’s jump in!

-Enjoy, Naeem, CEO & Founder - Risk On Q

PICKS:

Banks - Citi needs to defend risk management

AI - The Race is On

Fines - TD Bank’s AML Further Details

Risk Headlines

Key Points:

Citigroup faced challenges during its recent earnings announcement, despite beating expectations and showing revenue growth across all divisions. CEO Jane Fraser's initial lack of clarity regarding potential regulatory constraints, specifically an asset cap, caused confusion among investors and analysts. The bank's stock performance lagged behind its competitors, and concerns remain about its ability to meet profitability targets while addressing regulatory issues.

Citigroup faces ongoing regulatory challenges, including recent fines and calls for increased oversight. The specter of potential growth restrictions or even a breakup, as suggested by Senator Warren, looms large. The quick stock price reaction to the possibility of new regulatory constraints demonstrates the market's heightened sensitivity to regulatory risks in the banking sector. Is Citi the next bank to face asset cap restrictions after Wells Fargo and TD Bank?

_________________________________

Collateralized Loan Obligations ETF’s, Product Risk -source wsj.com

Key Points:

There is a growing popularity of Collateralized Loan Obligations (CLOs) and their increasing accessibility to retail investors through ETFs. Major asset managers are seeking SEC permission to launch new CLO ETFs. This indicates growing mainstream interest in CLOs and potential for increased competition in the market. CLO sales have risen significantly, from $87 billion to $147 billion year-over-year. CLOs have been top-performing fixed-income investments in 2024, with yields at their highest levels in decades. However, there is potential risks associated with these complex financial instruments, particularly in the event of an economic downturn, could this be a similar event like the Collateralized Debt Obligation (CDO) fallout in 2008.

A.I. Risk / Technology Risk

JP Morgan Leads Banking Sector in AI Adoption - source ciodive.com

Key Points:

The report highlights the banking sector is seeing intense competition in AI adoption, with JPMorgan Chase leading the pack due to its early and substantial investments in AI talent and research. Their strategy of balancing speed with prudence, establishing dedicated AI research teams, and implementing large-scale AI tools like LLM Suite has paid off.

The report also underscores the importance of responsible AI adoption, given the highly regulated nature of the banking industry. The competition in AI adoption is intensifying, with banks like Capital One gaining ground through focused efforts on AI skills and development capabilities.

_________________________________

Nasdaq Integrates AI to Simplify & Accelerate Bank & Insurance Risk Calculations - source manilatimes.net

Key Points:

Nasdaq's integration of AI into risk calculations represents a convergence of advanced technology with financial risk management. This innovation addresses the growing complexity of risk calculations driven by market volatility, regulatory requirements, and sophisticated financial instruments.

The technology promises to dramatically reduce computation time and infrastructure needs while maintaining accuracy, potentially transforming how financial institutions approach risk management. This development underscores the increasing role of AI and machine learning in financial services, particularly in areas requiring complex, high-volume calculations.

AI-driven acceleration of complex risk calculations

Reduction in computational infrastructure needs

Adaptation to real-time market conditions

Potential for improved regulatory compliance and risk management

Intersection of AI technology and financial services

Regulatory News - Fines, Losses, & Rules

FDIC says, Recovery of US Bank Failure Fund Ahead of Schedule - source reuters.com

Key Points:

The FDIC's report paints a picture of a recovering and largely resilient banking sector, with the Deposit Insurance Fund rebuilding faster than expected. The DIF balance stood at $129.2 billion as of June 30, representing 1.21% of all insured deposits. The fund is approaching its legally required level of 1.35%, which could impact regulatory requirements and bank operations.

This positive trend could lead to reduced regulatory pressure and potentially lower insurance premiums in the future. However, the increase in "problem banks" and rising non-current ratios in commercial real estate and consumer portfolios warrant close attention.

_________________________________

The Money Laundering Behind TD Bank’s $3 Billion Fine - source wsj.com

Key Points:

This is fascinating listen to TD Bank’s AML fallout. The bank was found to have severe deficiencies in its anti-money laundering systems, which allowed criminals to launder over $670 million through the bank, including over $470 million linked to a single Chinese money laundering ring. Internal reports show that TD Bank employees were aware of the suspicious activity but failed to take action, and the bank's outdated monitoring systems missed 92% of its transaction volume.

Risk Data to Geek Out On

European Central Bank Fresh Approach for Improving Culture & Risk Governance at European Banks - source garp.org by Marco Folpmers

Key Points:

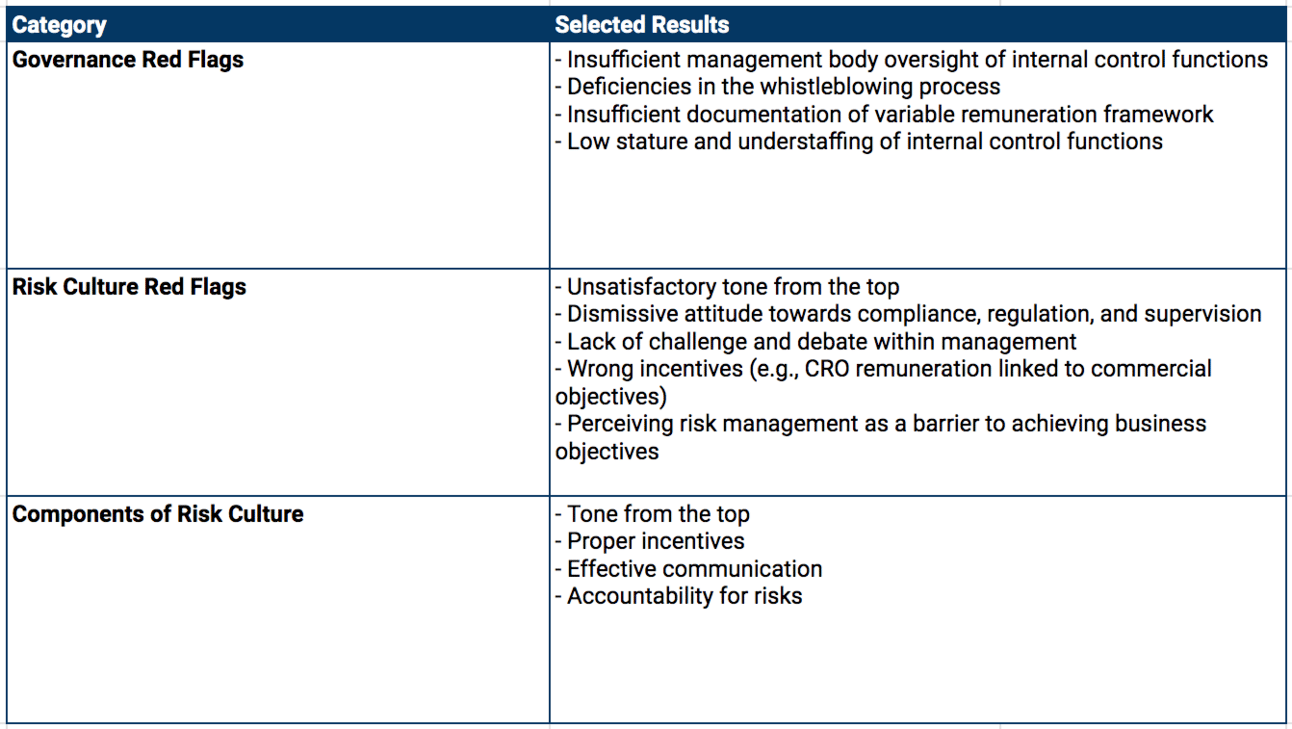

Last week we took a look at Deloitte’s best practices on “reputation risk” in light of TD Bank unprecedented $3 Billion dollar fine. This week we are looking at the ECB's new guidance on governance and risk culture. ECB is introducing the concept of red flags and negative indicators, they are acknowledging that traditional, positive-only assessments may not capture the full picture of a bank's risk culture.

Key points and their implications:

Red flags as early warning signals: The ECB's list of red flags provides banks with specific indicators of poor governance and risk culture. This allows for earlier identification and addressing of potential issues before they escalate into more serious problems.

Negative checklist approach: This novel approach complements traditional positive checklists, enabling a more comprehensive assessment of risk culture. It may lead to the development of new risk management tools and methodologies in the banking sector.

Four components of risk culture: By breaking down risk culture into four key components (tone from the top, proper incentives, effective communication, and accountability), the ECB provides a clear framework for banks to assess and improve their risk management practices.

Timing of the guidance: Issuing this guidance during a period of relatively low macro-risk underscores the importance of proactive risk management. It suggests that regulators expect banks to use periods of stability to strengthen their risk management capabilities.

Invitation for feedback: The ECB's call for comments from banks indicates a collaborative approach to regulation, potentially leading to more effective and practical guidelines.

_________________________________

Thank you for reading,

Naeem

p.s. If you find the Risk Queue newsletter helpful please subscribe and share it with a friend or colleagues, you can find it here!