- Risk Queue

- Posts

- Bank Earnings Underway; AI Success Path for Banks

Bank Earnings Underway; AI Success Path for Banks

ALSO: Executives Strong Feedback About Risk Management Org

Hello Everyone, I hope you had a wonderful week. The Risk Queue has a lot of activity taking place!

-Thank you, Naeem, CEO & Founder - Risk On Q

PICKS

Earnings- Banks report performance

Jobs- Risk roles are coming under pressure.

AI - Key paths in Gen AI implementation for Banks to succeed.

Risk Headlines

Banks Start Reporting Earnings - source wsj.com

Key Points:

Several key risks facing bank earnings, including commercial real estate exposure, rising loan losses, significant unrealized securities losses, and pressure from higher rates. These factors collectively signal growing stress in the banking system and the negative impacts to earnings and capital will be closely monitored.

Banks need to carefully manage these risks by stress testing portfolios, increasing loan loss reserves, optimizing balance sheet liquidity and stability, and controlling costs. The industry also must hope that the Fed can engineer a soft landing. Because a deep recession on top of these pre-existing risks could be devastating for some.

_________________________________

Lloyds Bank’s Move to Axe Risk Staff, as Executives Complain They Are A ‘Blocker’ - source financialtimes.com

Key Points:

The delicate balance between risk management and strategic agility to remain competitive and drive growth in a rapidly changing market has now come into focus for CEOs, CFOs, and CROs. Lloyds' internal review reveals that risk management is perceived as a blocker by two-thirds of executives. Is this the only bank that has this challenge? Unlikely. Lloyds' plan to reset its approach to risk and controls, focusing initially on non-financial risks and streamlining risk processes to enable faster decision-making and strategic progress.

A proactive and adaptive risk management approach that aligns with strategic goals, fosters a culture of intelligent risk-taking, and effectively manages financial and non-financial risks is essential for long-term success in the banking industry. Are you looking to pivot your firm’s risk management strategy? We have the risk management software that can enable a bank to "move at a greater pace while meeting a firm's risk management commitments that executives and regulators are seeking." Please reach out to me to learn more about how we can assist you in this critical journey.

A.I. Risk / Technology Risk

How Financial Services Firms Can Unleash The Power Of Generative AI - source forbes.com

Key Points:

Generative AI will impact virtually every part of every business. Upgrading digital core, data, skills, risk management, and culture are prerequisite to capture full value from AI. Bank’s leadership cannot treat AI as an isolated technology initiative, but rather an organization-wide strategic priority that will have profound impact to customers and shareholders.

_________________________________

Key Points:

The IMF's assessment of cybersecurity in its financial risks report emphasizes the urgent need for the financial sector to prioritize and strengthen their cyber defenses to prevent potential systemic risks. As digitization increases and regulations remain inadequate, banks must prioritize strengthening their cyber defenses and governance. The lack of data about cyberattacks hinders the understanding of potential systemic dangers, highlighting the need for greater information sharing and collaboration among financial institutions.

Regulatory News - Fines, Losses, & Rules

Key Points:

Morgan Stanley's wealth management division is currently under investigation by multiple federal regulators, according to a report from The Wall Street Journal. The scrutiny is over how anti-money laundering (AML) and "know your customer" (KYC) regulations are handled for clients who may be at risk of laundering money through the bank's operations. This is in addition to the Federal Reserve probe that was reported in November by the WSJ.

_________________________________

PCAOB (Public Company Accounting Oversight Board) Fines KPMG $25 Million in Exam - Cheating Scandal - source wjs.com

Key Points:

The PCAOB imposed its largest monetary penalty to KPMG for violating quality-control rules. The PCAOB also found these violations occurring at Deloitte.

_________________________________

FDIC Chairman Presents Plan for Orderly Resolution of U.S. Large Banks - Taxpayer Off the Hook - source fdic.gov

Key Points:

The FDIC has developed a comprehensive framework and operational capabilities to manage the orderly resolution of a failed Global Systemically Important Bank (GSIB) under Title II of the Dodd-Frank Act. This includes the Single Point of Entry (SPOE) resolution strategy. The FDIC's readiness to handle a GSIB failure without bailouts or major systemic disruption significantly reduces the "too big to fail" risk that concerned regulators and the public after the 2008 financial crisis. This enhances overall financial stability.

Risk Data to Geek Out On

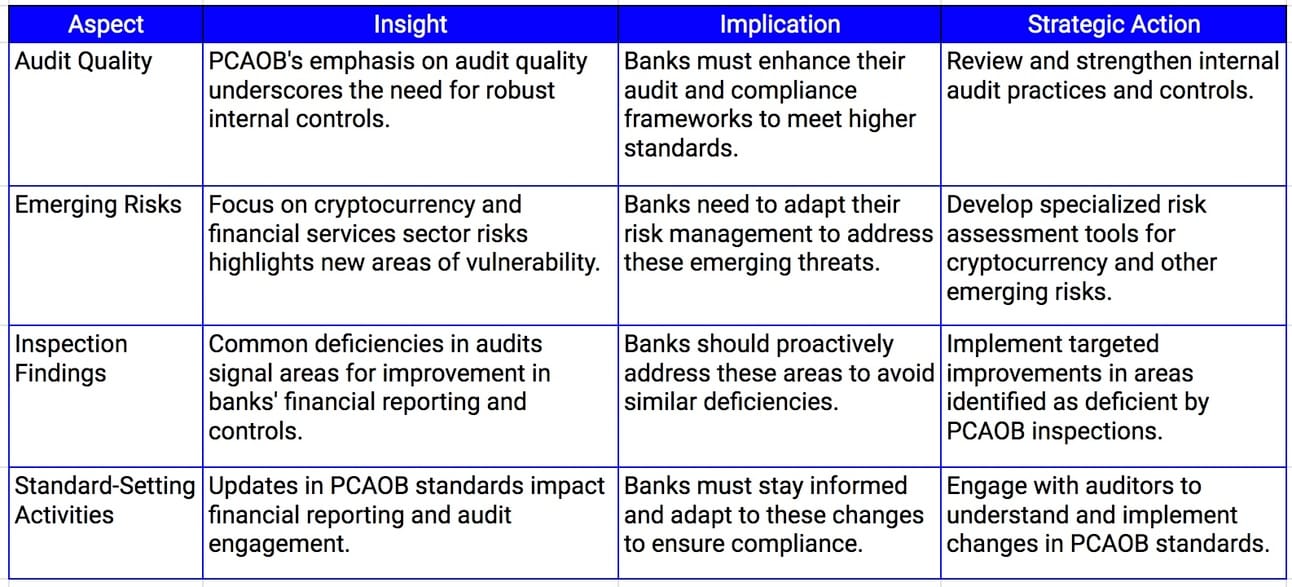

Audit Excellence in Banking - Mastering the PCAOB’s Roadmap - source pcaobus.org

Key Points:

The PCAOB's intensified focus on audit quality, emerging risks, and specific deficiencies identified in the report underscores the need for banks to enhance their audit practices, risk management frameworks, and strategic governance.

These efforts are critical not only for compliance but also for maintaining investor confidence and competitive advantage. The PCAOB's activities and priorities signal a regulatory environment that is increasingly attentive to the complexities of modern financial reporting and the associated risks.

Enhanced audit quality and investor protection are paramount for maintaining market confidence.

Emerging risks like cryptocurrency require banks to adapt their risk management and reporting practices.

Common audit deficiencies highlight areas for banks to strengthen their internal controls and compliance.

Updates in PCAOB standards necessitate proactive engagement and adaptation by banks.

_________________________________

Thank you for reading,

Naeem

p.s. If you find the Risk Queue newsletter helpful please subscribe and share it with a friend or colleagues, you can find it here