- Risk Queue

- Posts

- $89M Fine for Goldman & Apple; AI's focus on Risk Management; SEC 2025 Exam Priorities

$89M Fine for Goldman & Apple; AI's focus on Risk Management; SEC 2025 Exam Priorities

Hello everyone! Welcome back to the Risk Queue. This week, Goldman and Apple feel the regulatory pressures, SEC 2025 priorities and AI in risk jobs and managing financial risk management. Let’s jump in!

-Enjoy, Naeem, CEO & Founder - Risk On Q

PICKS:

Fines - Goldman and Apple Face CFPB

Regulators - SEC 2025 Exam Priorities

AI - Risk Professional Focus

Risk Headlines

Goldman Sachs & Apple Faces CFPB Fine Exceeding $89 Million Over Credit-Card Business - source cnbc.com

Key Points:

CFPB penalty reveals a critical intersection of regulatory, operational, and strategic failures in their Goldman’s consumer banking venture, amplified by rigid tech partnership constraints with Apple that created systematic customer service bottlenecks. The $89 million penalty and ban on new credit card launches demonstrates regulators' focus on consumer protection in digital banking initiatives.

Enforcement Details

Financial Penalties

Goldman Sachs: $64.8M total ($45M penalty + $19.8M redress)

Apple: $25M penalty

Ban on new credit card launches for Goldman

Violations Identified

Consumer dispute mishandling

Misleading communications

Interest charge issues

Credit reporting inaccuracies

Operational Failures

Consumer Dispute Processing

Failed dispute routing

Inadequate investigation procedures

Communication breakdowns

Product Feature Implementation

Interest-free payment plan issues

Customer communication failures

Technology integration problems

_________________________________

SEC Division of Examinations Announces 2025 Priorities -source sec.gov

Key Points:

The SEC's 2025 examination priorities reflect an increased focus on technology risks, operational resilience, and emerging market challenges. Banks should expect heightened scrutiny of cybersecurity practices, AI implementation, and third-party risk management.

The acceleration to T+1 settlement and enhanced customer data protection requirements will require significant operational adjustments. Compliance programs must adapt to address these evolving priorities while maintaining core controls around fiduciary obligations and AML requirements.

Risk Areas Impacting Various Market Participants.

○ Operational Resiliency and Information Security:

Cybersecurity: The SEC will continue to prioritize cybersecurity, reviewing registrants' practices to protect investor information, records, and assets from cybersecurity threats. This includes examining their policies, governance, data loss prevention, access controls, incident responses (especially ransomware attacks), and safeguards for confidential trading information.

Regulation S-ID and Regulation S-P: The SEC will assess compliance with regulations designed to protect customer information, including policies, controls, third-party vendor oversight, governance, and practices to prevent identity theft and account intrusions. They will also evaluate firms' preparedness for implementing incident response programs as required by amendments to Regulation S-P.

Shortening of the Settlement Cycle: The SEC will examine broker-dealers' and advisers' compliance with rules related to the shortened settlement cycle (T+1), including their operational changes, technology adjustments, and adherence to deadlines.

A.I. Risk / Technology Risk

Gen AI Use Cases & Challenges for Financial Risk Management - source garp.org

Key Points:

Boston Consulting Group (BCG) and member of GARP's Risk and AI Advisory Committee, discussing the intersection of generative AI with financial risk management. The discussion of Gen AI's potential benefits, including its ability to process information quickly, generate reports, and assist with model validation is a key focus. However, they also highlight the risks associated with Gen AI, such as data leakage, intellectual property concerns, and the potential for AI to generate inaccurate or misleading information, also known as "hallucinations”.

The podcast also addresses the need for Gen AI governance and the potential impact of Gen AI on risk-related jobs. The guests argue that Gen AI can significantly improve risk management processes, but it is crucial to implement appropriate safeguards to ensure its responsible and effective use.

_________________________________

The Evolution of DataOps - Lessons from a Decade of Transformation - source ateaminisigt.com

Key Points:

DataOps has evolved from a technical solution to a fundamental business strategy, driven by the convergence of big data, cloud computing, and AI. The past decade demonstrates that successful implementation requires balancing technological advancement with organizational readiness, emphasizing both automation and human expertise while maintaining strong governance frameworks. With the market approaching $11B by 2028 and increasing regulatory complexity, banks must prioritize DataOps integration focusing on master data management, cross-functional implementation, and measured AI adoption.

Regulatory News - Fines, Losses, & Rules

Goldman Finds New Ways to Slice and Dice Loans - Regulators Concerned About Systemic Risk -source wsj.com

Key Points:

Wall Street is innovating with new financial products, exemplified by Goldman's pioneering $475M ABS bonds backed by capital-call loans to fund managers. While these products show promising returns and historically low default rates, they represent increasing interconnectedness between traditional banking and private credit markets that regulators are watching closely.

The convergence of traditional banking and private markets is creating a complex web of circular risk exposure, banks provide capital-call loans to private funds, who in turn provide risk protection back to banks through SRTs (synthetic risk transfers), while simultaneously developing competing products like NAV (based on net asset values) loans. Could these innovations create new forms of systemic risk not captured by current regulatory frameworks?

Risk is being redistributed rather than reduced

Private market players are becoming quasi-banks

Innovation is outpacing regulatory frameworks

Limited historical data on new product performance

_________________________________

OCC Report on Interest Rate Risk for Midsize & Community Banks - source wsj.com

Key Points:

The OCC’s supervisory process includes a review of bank-reported IRR data, including exposures, risk limits, and non-maturity deposit (NMD) assumptions. The OCC compiles these data and breaks them down into statistics for different populations of banks and publishes semiannually to establish the range of exposures and risk limits across midsize and community banks.

Risk Data to Geek Out On

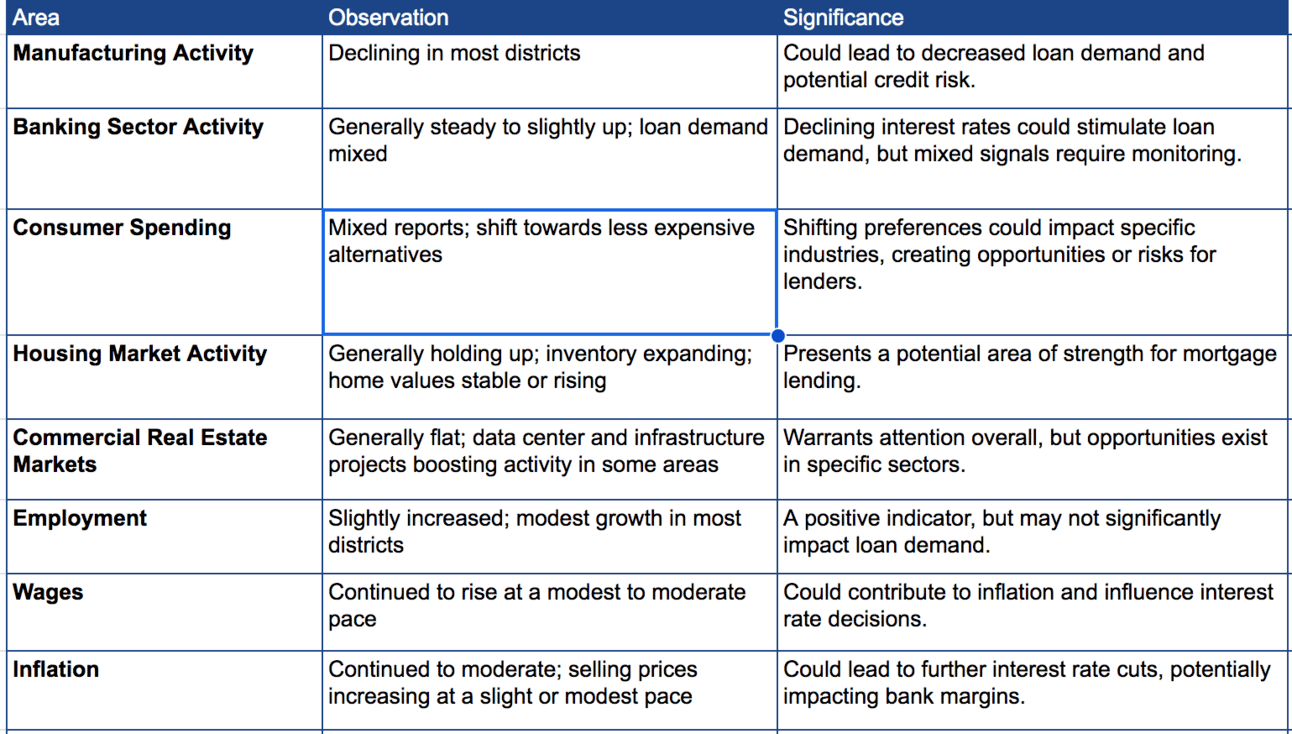

Federal Reserve Commentary on Current Economic Conditions- Beige Book October 2024 - source federalreserve.gov

Key Points:

The Beige Book, this report is published eight times per year. Each Federal Reserve Bank gathers anecdotal information on current economic conditions in its District through reports from Bank and Branch directors and interviews with key business contacts, economists, market experts, and other sources.

The report presents a qualitative overview of economic activity, labor markets, prices, consumer spending, and other key economic indicators, providing insights into regional and national economic trends. The Beige Book does not reflect the views of Federal Reserve officials but serves as a valuable source of information for policymakers and the public.

The latest Beige Book indicates economic activity remains stable but subdued across most regions, with manufacturing showing particular weakness. While labor markets have eased somewhat, wage pressures persist at modest levels and skilled worker shortages continue in certain sectors. Inflation is moderating overall, though profit margins are being squeezed as input costs rise faster than selling prices. The banking sector shows some improvement in outlook tied to recent interest rate declines.

_________________________________

Thank you for reading,

Naeem

p.s. If you find the Risk Queue newsletter helpful please subscribe and share it with a friend or colleagues, you can find it here!