- Risk Queue

- Posts

- Interest Rate Risk Not Going Away; EU Passes AI Legislation

Interest Rate Risk Not Going Away; EU Passes AI Legislation

ALSO: The "Unicorn Regulation" is Back; SEC Gensler Provides AI Risk for Wall Street

Hello Everyone, hope you are having an outstanding day, this week’s Risk Queue is ready!

-Naeem, CEO & Founder - Risk On Q

PICKS

Interest Rate Unchanged- Prediction from six rate cuts to three now.

AI in the EU- Europe Passes AI Legislation.

Unicorn Regulation - The Fines Add Up.

Risk Headlines

Federal Reserve Needs More Data Before Cutting Interest Rates - source cbsaustin.com

Key Points:

The Federal Reserve left rates unchanged, the daunting task facing the Fed in seeking to cool inflation without causing undue economic pain.

- Unchanged rates despite high inflation

- Projected rate cuts signal inflation optimism

- Strong jobs market complicates soft landing

- High rates strain consumers

The monetary policy path from here will have major implications for banks, households, businesses, and the broader economy. Upcoming data will be critical in shaping the rate path and recession odds. However, the Fed's projections still point to multiple rate cuts before year-end.

Banks will continue to stress test for scenarios including stickier inflation, resumed Fed hikes, and a harder landing. This will likely keep the credit, liquidity, and interest rate risks teams very busy.

A.I. Risk / Technology Risk

EU Passed The World’s First Comprehensive AI Legislation - source dailyai.com

Key Points:

The EU AI Act is a comprehensive legislation that regulates AI systems based on their potential threats and risks, promoting transparency and accountability in AI development and deployment. This will be monitored closely by other countries.

The EU AI Act introduces a risk-based approach to AI governance.

High-risk AI systems will undergo rigorous assessments pre and post-market launch.

Generative AI systems must meet transparency requirements and EU copyright law.

Non-compliance can result in fines of up to 35 million Euros or 7% of worldwide annual turnover.

_________________________________

Securing Generative AI: Applying Relevant Security Controls - source aws.amazon.com

Key Points:

This is a comprehensive guide to securing generative AI application risk based on their scope, which is determined by who controls the application, data, and model. It emphasizes the importance of applying standard security best practices like identity and access control, encryption, and monitoring to generative AI applications, while also highlighting unique considerations for fine-tuning and self-training models.

_________________________________

SEC Chair Gensler on AI’s Risk to Wall Street - source politico-tecn.simplecast.com

Key Points:

SEC chair Gary Gensler expressed concerns that AI, particularly the use of large language models by financial analysts for market predictions, could potentially contribute to a future economic crisis.

If the world's largest banks rely on the same large language model (LLM) for financial advice, misinformation could quickly spread through the economy if the model's predictions are inaccurate. To protect financial institutions, SEC chair Gary Gensler emphasizes the importance of using diverse models and data sources.

Regulatory News - Fines, Losses, & Rules

CFTC Fines U.S. Bank $6 Million & Oppenheimer $1 Million For Recordkeeping & Supervision Failures 🦄 - source cftc.gov

The widespread use of unapproved communication methods by employees, including senior-level staff and supervisory personnel, indicate to regulators a systemic failure in compliance and supervision. This not only violates regulatory requirements but also hinders the firms' ability to provide records promptly when requested, potentially leading to further regulatory scrutiny and reputational damage as seen at other financial institutions.

Since December 2021, the CFTC has imposed $1.124 billion in civil monetary penalties on 22 financial institutions for their use of unapproved communication methods, in violation of CFTC recordkeeping and supervision requirements. We have coined the recordkeeping rule as "The Unicorn Regulation" based on the significant monetary amounts collected by regulators specifically for violations of just this one rule.

_________________________________

2023 FINRA Sanctions Analysis - source eversheds-sutherland.com

Eversheds Sutherland (US) LLP's annual study of FINRA disciplinary actions for 2023 reveals a decrease in disciplinary actions and restitution orders, but a significant increase in fines, with spoofing, trade reporting, anti-money laundering, Regulation Best Interest (Reg BI), and suitability being the top five enforcement issues by total fine. The number of disciplinary actions and orders of restitution decreased compared to 2022, but fines increased significantly, largely due to a $24 million fine.

_________________________________

Federal Bank Regulators Seek Comment to Reduce Regulatory Burden - source occ.gov

The federal bank regulatory agencies have initiated a series of requests for comment to reduce regulatory burden, focusing first on Applications and Reporting, Powers and Activities, and International Operations. Banks will have the opportunity to provide valuable input on outdated, unnecessary, or unduly burdensome regulations within the 90-day comment window and through upcoming outreach meetings.

Risk Data to Geek Out On

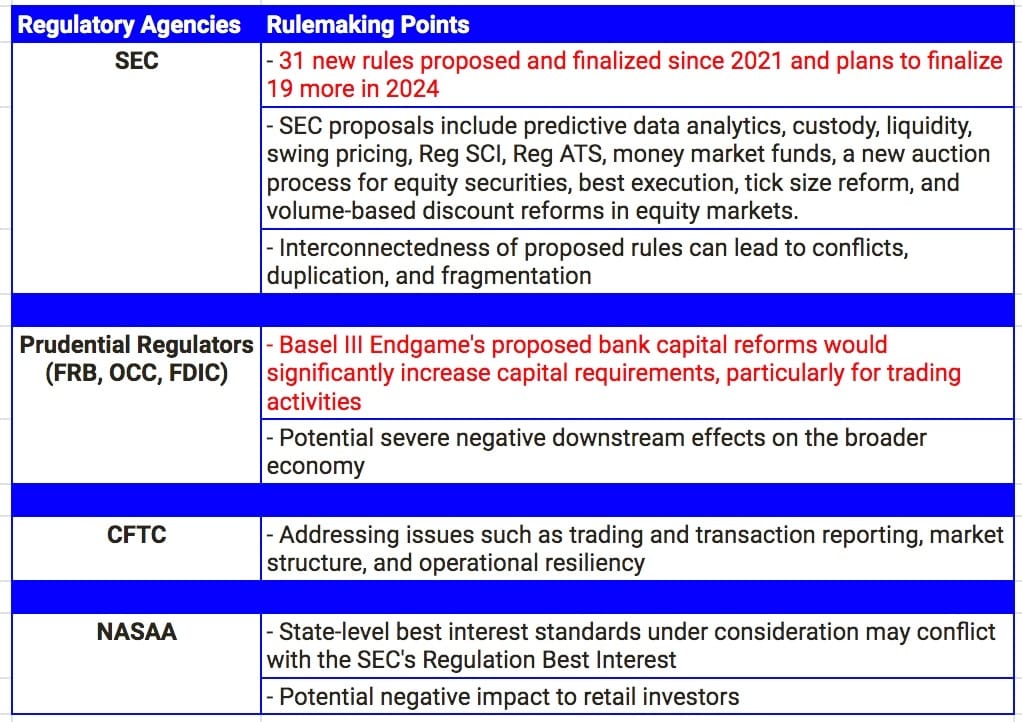

SIFMA Details Banks’ Numerous Upcoming & Existing Regulations To Be Managed On A Day-to-Day Basis - source SIFMA.org

Key Points:

SIFMA provides details on the complex and evolving regulatory environment facing banks and financial markets, with numerous interconnected rule proposals from various agencies that could lead to conflicts, duplication, and fragmentation.

The high volume and interconnectedness of SEC regulatory changes, along with the Basel III capital reforms and potential conflicts with state regulations, pose significant challenges for banks in terms of compliance, implementation, and potential negative market consequences.

It is crucial that banks proactively assess and manage the risks associated with the evolving regulatory landscape, develop robust compliance strategies, and engage with regulators and industry groups to navigate potential challenges and advocate for a more cohesive regulatory environment. Table below provides agencies efforts.

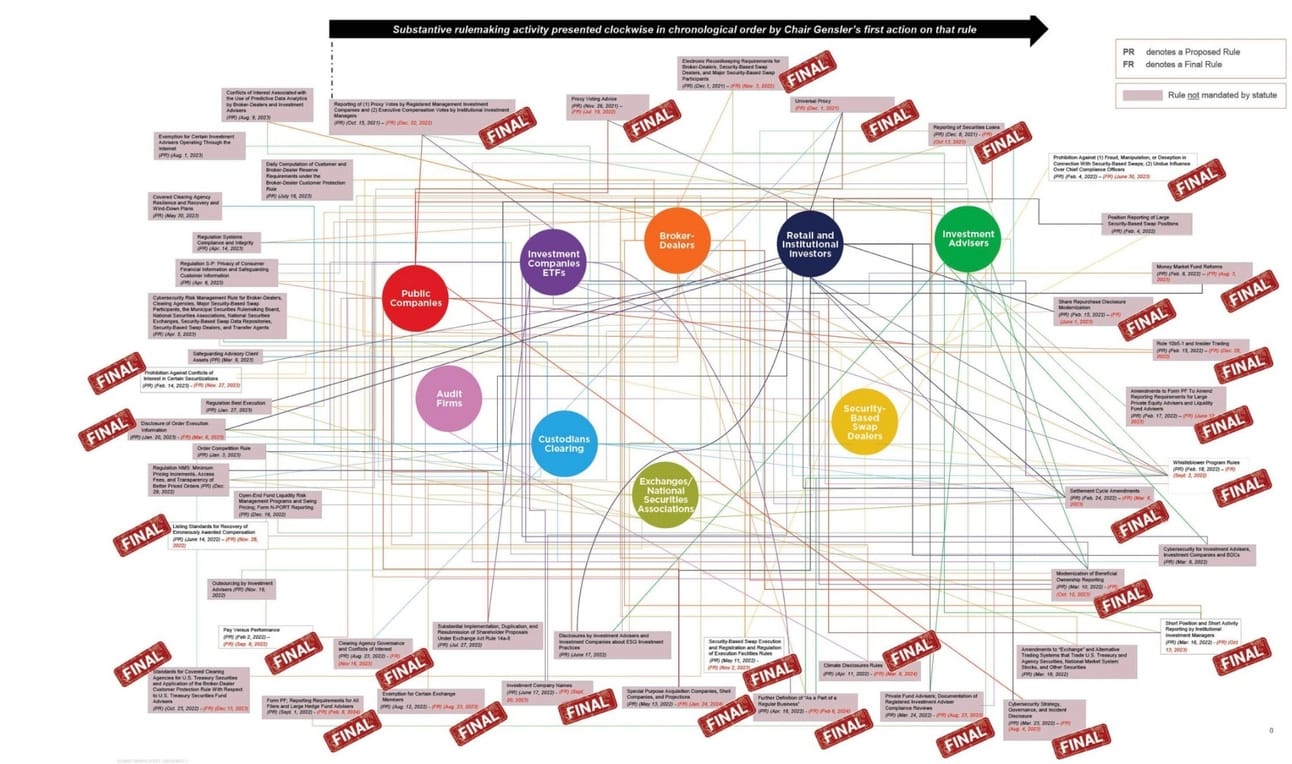

Regulatory Incidence of SEC Proposed & Final Rulemakings (Gensler Chairmanship, April 17, 2021 to March 14, 2024)

Based upon a diagram originally published by the Committee on Capital Markets Regulation (Check out the diagram at the link for better viewing)

_________________________________

Thank you for reading,

Naeem

p.s. If you find the Risk Queue newsletter helpful please subscribe and share it with a friend or colleagues, you can find it here