- Risk Queue

- Posts

- Lets Go 2024, Bank's Top Risk!

Lets Go 2024, Bank's Top Risk!

ALSO: Risk Functions & Regulators Rush to Keep Pace with AI; FINRA's playbook

Hello Everyone, Happy New Year! I wish each of you renewed energy and focus to conquer 2024.

Thank you for starting the new year with Risk Queue. Our goal is to continue providing a diverse set of risk data, content, and actionable insights. These will help you supercharge your risk expertise and to accelerate your career and empower you to make informed decisions as we navigate this complex financial and non-financial risk landscape together!

Lets get started,

Naeem Qasim

CEO & Founder, Risk On Q

PICKS

Banks top risk in 2024 - Which risk priorities will drive the agenda at Banks, regulators have a list of items for focus. (See summary below)

AI is at an accelerated pace, what will risk functions and regulators need to do keep pace.

Much more: regulatory fines, Basel Endgame, and FINRA provides firms insights for 2024!

Risk Headlines

Top Bank Risk for 2024 - source American Bankers Association.com

Key Points:

The American Bankers Association provides five significant risk challenges and impacts for Bank’s in 2024:

1) Basel III Capital rule overhauls could constrict funding availability industry-wide and introduce stability risks.

2) Commercial Real Estate exposure will need close tracking for distress signals.

3) Regulatory mandates across the businesses will require major investments in reporting systems and operational talents.

4) Criminals will likely leverage AI capabilities such as voice/identity synthesis to defeat authentication checks and perpetrate fraud at scale.

5) Cyberattack are accelerating for financial firms as they are high reward targets for bad actors.

**Here is our perspective at RiskOnQ on the top financial and non-financial risk for Banks in 2024, in the below table:

A.I. Risk / Technology Risk

Risk Functions & Regulators Rush to Keep Pace in AI Advancements- source McKinsey.com

Key Points:

Regulators and Risk professionals will need to establish rigorous safety protocols and testing, models risk hallucinating false information that distorts decision-making will hinder future business and operational opportunities. Guardrails in development are crucial, explainability features are needed, and centralized inventories, taxonomies and oversight are vital.

____________________________________________________________

Discussion on the Progress of the NIST Artificial Intelligence Risk Management Framework (AI RMF)- source fairinstitute.org

Get the overview from NIST on the AI risk framework and how organizations can adopt responsible AI.

____________________________________________________________

Compliance Risk Trends Fintechs Should Consider - source thefinancialbrand.com

Regulators are increasing scrutiny of bank-fintech partnerships, adding pressure on fintechs to grow while complying with regulations.

Regulatory News - Fines, Losses, & Rules

SEC Fines Morgan Stanley $249 million For Sharing Information About Clients’ Stock Sales - source reuters.com

The debate on how confidential information was managed, was this material non-public information? The settlement ends a long-running probe into how the bank sold large blocks of stock for institutional investors.

____________________________________________________________

CFPB & OCC Orders U.S. Bank to Pay $35 Million for Illegal Conduct - source consumerfinance.gov

The CFPB and OCC coordinated investigations into U.S. Bank’s illegal conduct on tens of thousands of American workers from accessing unemployment benefits during the Pandemic.

____________________________________________________________

SEC Top Enforcer Says Tougher Penalties Are Working - source wsj.com

____________________________________________________________

OCC Acting Comptroller Takes on ‘Drive Fast, Crash’ Risk Culture - source wsj.com

Emerging Risk

Bank Policy Institute & the American Bankers Association provide joint notice to Regulators on Basel Endgame Proposal - source bpi.com

The comment letter criticizes the fragmented approach to the design and calibration of the bank capital framework and the lack of supporting data analysis of cost and benefits in the proposal. The proposed rule covers four categories of risk: credit risk, operational risk, market risk, and credit valuation adjustment (CVA) risk. Many items for Regulators to consider here and the different perspectives continue to enrich the conversation.

Risk Data to Geek Out On

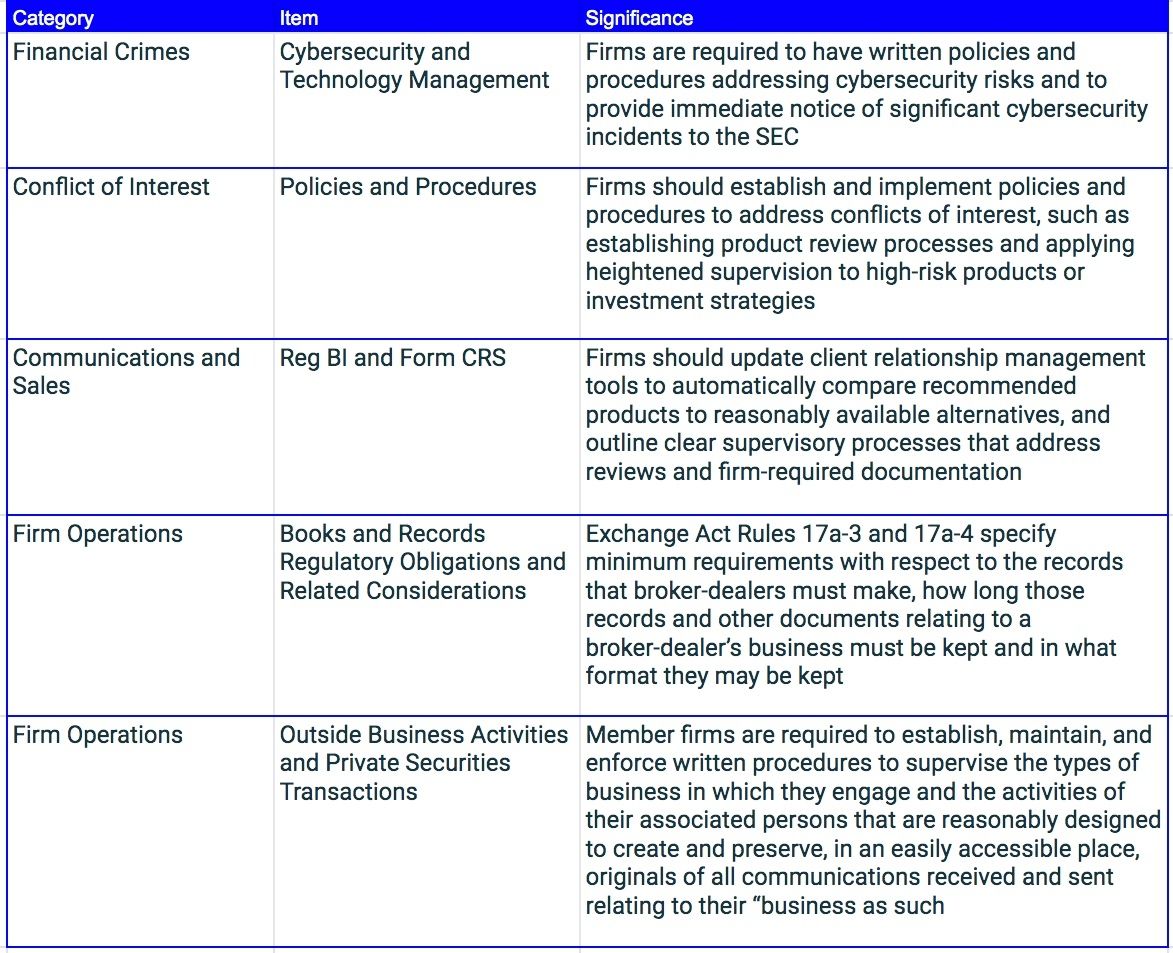

2024 FINRA Annual Regulatory Oversight Report - source FINRA.org

FINRA provides a roadmap of key regulatory obligations and effective practices related to firms operations, financial crimes, conflict of interest, artificial intelligence, communications and sales, which are crucial areas for ensuring compliance and ethical conduct within the banks. This is an in-depth resource for risk and compliance functions in fulfilling firms compliance obligations.

Thanks for reading, Until next time!

Naeem

p.s. if you want to sign up for the Risk Queue newsletter or share it with a friend or colleagues, you can find it here