- Risk Queue

- Posts

- Wall Street Wins on Basel III "Endgame"; Regional Banks Risk Management in Focus

Wall Street Wins on Basel III "Endgame"; Regional Banks Risk Management in Focus

ALSO: Citi & Generative AI; WSJ on the Trillion-Dollar Hidden Risk in Tech

Hello Everyone, get ready to dive into the thrilling world of risk management because we’ve got an exciting lineup in the Risk Queue this week!

-Naeem, CEO & Founder - Risk On Q

PICKS

Banks take on Basel III- Banks are getting relief from Basel III.

Tech Debt- Banks’ Old Technology Cost.

Regional Banks- Check your Risk Management Capabilities.

Risk Headlines

Regulators Listen to Wall Street: Basel III Capital Burden Likely to Ease - source reuters.com

Key Points:

Valuable insights into the expected changes to the proposed Basel III rule, which aims to overhaul how large banks calculate the capital they must set aside to absorb potential losses. The revelation that U.S. regulators are likely to significantly reduce the extra capital burden on banks is a crucial development for the banking industry. The anticipated changes, particularly in the calculation of operational risk losses and the reduction of risk weights for low-income mortgages and renewable energy tax credits, are expected to result in the most significant capital savings for banks. These adjustments could have far-reaching implications for banks' operations and their ability to support specific sectors of the economy.

The involvement of high-level Fed officials and the intense opposition from banks underscore the importance of the rule and the need for a balanced approach that addresses industry concerns while maintaining financial stability. Regulators have raised operational risk as a top risk concern year after year for all the banks and they will have to consider carefully the revisions they make on this key risk.

_________________________________

Is a Regional Banking Crisis Looming? Market Jitters Rise After NYCB Troubles Deepen - source wsj.com

A worrisome picture for regional banks as New York Community Bancorp (NYCB) woes serve as a stark reminder of the risks facing banks with heavy concentrations in commercial real estate. Additionally, the identified internal control weaknesses raise questions about the bank's ability to effectively manage its risk profile. The bank also named a new CEO, CRO, and head of Audit. NYCB's situation will likely invite increased regulatory attention to internal controls and risk management practices in the regional banking sector.

A.I. Risk / Technology Risk

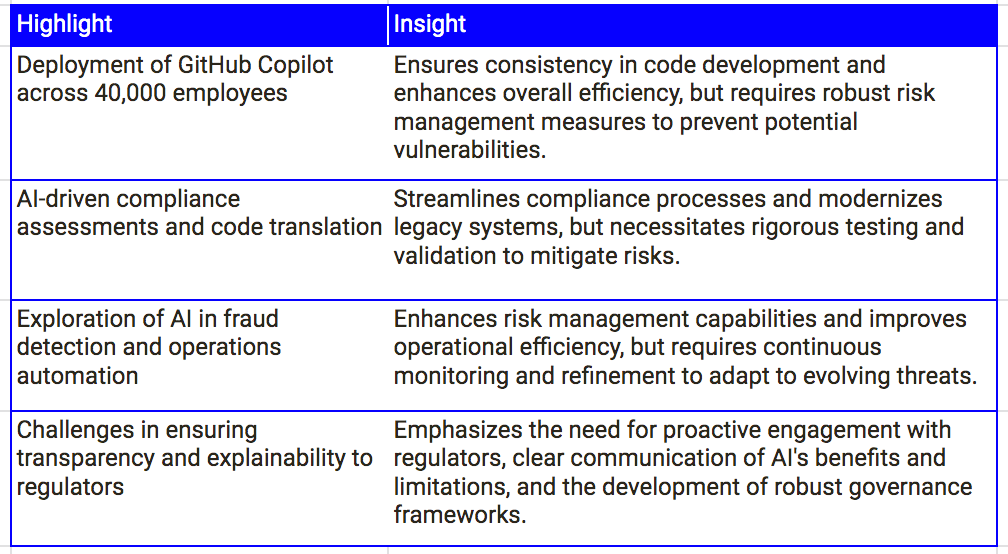

Citi Bank’s Journey into Generative AI - source bnnbreaking.com

Key Points:

Citi is integrating generative AI into its operations, particularly in code development, compliance assessments, and system modernization. However, challenges exist in ensuring transparency and regulatory compliance. The goals are clear in driving modernization, efficiency, and innovating with AI capabilities. AI can lead to a more agile and responsive banking ecosystem. AI is changing rapidly and will force Bank CEO’s to manage this top risk across all businesses.

_________________________________

Key Points:

The staggering figures presented—$1.52 trillion to fix technical debt and an annual cost of $2.41 trillion—underscore the magnitude of the problem and the urgent need for action. For bank CEOs, this information serves as a wake-up call, highlighting the potential financial, security, and operational risks that technical debt poses to their institutions. The long-term stability, security, and competitiveness of their institutions depend on their ability to effectively manage and reduce technical debt.

Regulatory News - Fines, Losses, & Rules

KPMG Fined $2 Million for Audit ‘Failures’ - source reuters.gov

The FRC found flaws in how KPMG planned and executed its audit work, including the failure to consider the risk of fraud and to obtain sufficient audit evidence.

_________________________________

FED’s Beige Book - Summary of Commentary on Current Economic Conditions - source federalreserve.gov

What is the Beige Book?

Purpose: The Beige Book provides a qualitative overview of current economic conditions across the United States, focusing on each of the 12 Federal Reserve districts. Its purpose is to give the Federal Reserve insights into regional trends to help inform monetary policy decisions.

Content: The report covers topics like:

Employment and wages

Consumer spending

Manufacturing activity

Real estate (both residential and commercial)

Banking and non-banking financial conditions

Agriculture and natural resources

Sources: The information is gathered from each District's business contacts, economists, and market experts through interviews and surveys.

Frequency: Published eight times per year, a few weeks before each Federal Open Market Committee (FOMC) meeting.

_________________________________

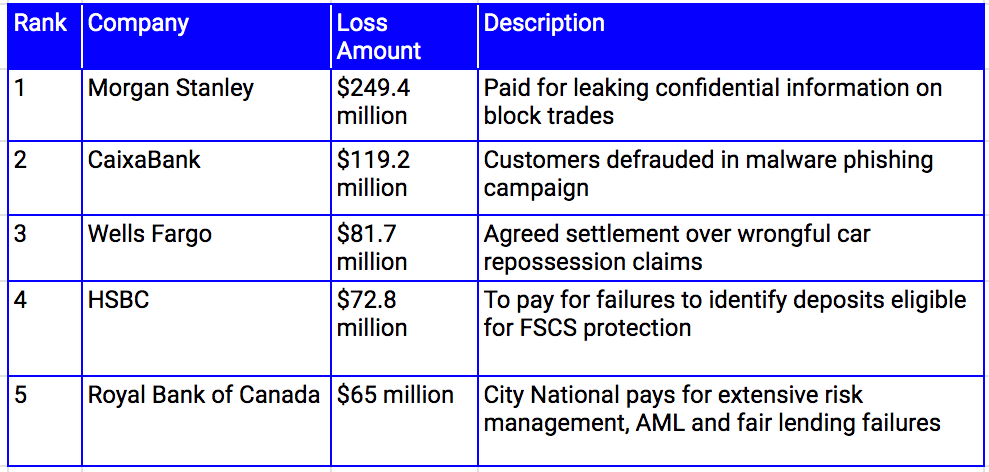

Top 5 Operational Risk Losses - Q1 2024 - source orx.org

The ORX team published the list of the five largest operational risk losses in the financial industry, these operational risk events highlight the diverse range of challenges facing organizations.

Source: ORX News

Risk Data to Geek Out On

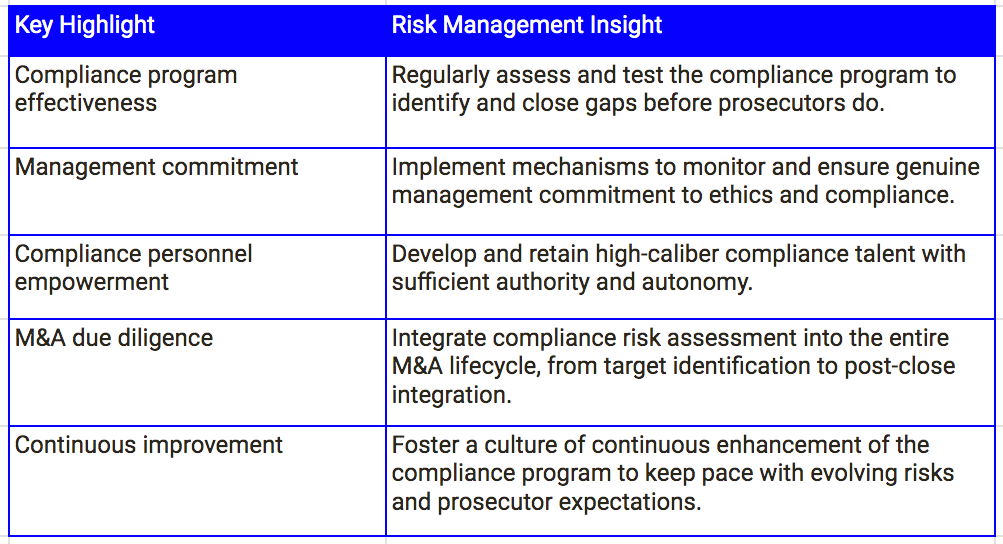

DOJ - Beyond Paper Compliance: Is Your Compliance Risk Program Prosecutor Proof - source justice.gov

The U.S Department of Justice Evaluation of Corporate Compliance Programs documents guidance on how prosecutors evaluate corporate compliance programs. The key takeaways are that a robust, well-resourced, and actively enforced compliance program is essential to mitigate the risk of criminal charges. Bank leadership must visibly commit to ethics and compliance, while ensuring that compliance staff have the necessary authority and resources to be effective.

The overarching message for corporations is that a compliance program must be more than just a perfunctory "check-the-box" exercise – it must be a robust, well-resourced, and actively managed function that permeates the entire organization. They will also assess the program's track record in preventing, detecting, and remediating misconduct. Simply crafting compliance policies is not enough; they must be vigorously implemented and enforced. Ultimately, compliance must be ingrained into the fabric of the bank’s culture and operations, a key priority that requires a strategic vision on risk management.

_________________________________

Thank you for reading,

Naeem

p.s. If you find the Risk Queue newsletter helpful please subscribe and share it with a friend or colleagues, you can find it here